1953

Congressional Employees Federal Credit Union (CEFCU) is founded

On July 9, 1953, eight congressional employees formed the credit union that would later become Congressional Federal Credit Union. George Grant, Hayden S. Garber, W.E. Hackett, Arista Huber, Alphonse Lucas, Ralph A. Patterson, Lucille Spain, and R.B. Veil established CEFCU to provide quality financial services to Members of Congress, employees of the U.S. House of Representatives, and their families.

1956

The credit union reaches $50,000 in assets

1957

Assets exceed $100,000

1959

Membership reaches 1000 accounts

In its formative years, Congressional Federal is operated by a staff of one from the folding room of the Longworth House Office Building. Business hours are Mondays, Wednesday, Fridays, and paydays.

1959 Annual Meeting Invite

March 1959 board meeting minutes

1960

Annual Meetings

The credit union's growth can be tracked through annual reports from the 1960s, the first full decade of operation for CEFCU.

1960 Annual Meeting Booklet Cover

1960 Annual Report, inside pages

1961 Annual Meeting Booklet

1961 Annual Meeting booklet, inside pages

1963 Annual Meeting Booklet Cover

1963 Annual Meeting Booklet, Inside Pages

1964 Annual Meeting Invitation

1964 Annual Meeting Invitation (Back)

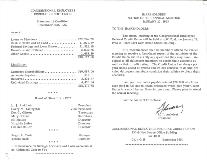

1965 President's Report

1965 Treasurer-Manager Report

1967

Loans exceed shares for the first time

The September 1967 board meeting minutes contain a note at the bottom: "Our loans have exceeded our shares for the first time!!" With 132 loan applications disbursed for the month, "we have been busy."

Congressman Wright Patman (D-TX 1) introduces the bill to establish the National Credit Union Administration (NCUA), the country's first independent credit union agency.

1968

The credit union reaches $1 million in assets

1970

"It's Nobody's Business but Yours"

A message on the back of the 1970 Annual Report reminds members that a credit union is literally your business: as a member of a cooperative, you are an owner and stakeholder.

"When you become a member of your Credit Union you do more than just deposit money in a financial institution. In reality you are joining an organization of friends dedicated to the idea of self-help."

Cover of the 1970 Annual Report

Inside Pages of the 1970 Annual Report

Back Cover of the 1970 Annual Report

1971

"Credit Union Goes Mod"

The credit union converts from passbook to computer processing of share and loan accounts. Roll Call newspaper profiled the technological advancement in an article titled “Credit Union Goes Mod.”

1972

Membership grows to 5000 accounts

1975

Defining our mission

CEFCU's board of directors expands upon our mission statement to focus on helping people gain financial independence: “to provide basic financial services to all our members with special emphasis on the deliverance of services to those in our field of membership who may lack financial mobility.”

1976

Our name changes to honor Wright Patman, credit union champion; Assets reach $10 million

The Board renames CEFCU “Wright Patman Congressional Federal Credit Union” to honor the late Congressman. Representative Patman fought to advance the credit union movement and consumer rights throughout his long career of service in Congress.

We begin offering Share Draft Accounts.

The Longworth Branch is renovated.

1977

The original Ford branch opens in Annex II

To accommodate continuing growth, the credit union opens a new dedicated branch in Annex II, now known as the Ford House Office Building. Members of Congress participate in the ribbon cutting ceremony, voicing support for the credit union and its services. Attendees include NCUA Administrator C. Austin Montgomery and Congressmen Clifford Allen, Frank Annunzio, Fernand St. Germain, and Henry S. Reuss.

WPCFCU joins NAFCU.

1977 Annex II Ceremony Invite

Representative St. Germain Speaks at the Annex II Opening

Michael Flaherty with Jim Molloy and Rep. St. Germain

Bob Kelly, Ed Kellaher, and Rep. Annunzio

Rep. St. Germain holds up a credit union t-shirt

1977 NCUA congratulatory letter to CFCU Manager Bob Hess

1978

6-month and 1-year share certificates are added to our portfolio

1979

Membership reaches 15,000 members and assets surpass $25 million

WPCFCU opens the Rayburn Branch.

1980

WPCFCU joins the ATM Cooperative

The CO-OP ATM network today provides members access to nearly 30,000 surcharge-free ATMs nationwide.

The credit union expands its savings portfolio with IRA accounts and special savings accounts such as the Christmas Club and Vacation Club.

1983

Celebrating our 30th Anniversary

The credit union joins Credit Union Mortgage Association (CUMA) and begins offering 1st Trust Loans.

1985

Ford Branch opens; Mortgage portfolio grows

The Ford Branch is opened in Annex II.

With the growing popularity of home renovations, the credit union creates a Home Improvement Loan. The board approves the offering of home equity lines of credit (HELOCs), first mortgages, and 15-year fixed mortgages through CUMA.

1991

Assets pass $100 million

1994

Congressional Federal purchases 10461 White Granite Drive

The credit union needed considerably more space for operations and staff as our member base and business needs expanded. In 1994, the board purchases the Oakton Center Building in Oakton, Virginia. The Board names it the James T. Molloy Building to honor Mr. Molloy's longtime service as an original board member.

1995

Renovations and updates on the Hill

The credit union's offices are located in House Office Buildings on Capitol Hill up until the mid-1990s. At this time, our Rayburn and Longworth branches are renovated.

Rayburn 1986

Longworth Rate Signage

Longworth teller line, 1990s

Behind the Longworth branch teller line, 1990s

1996

Our first Online Banking service launches

1997

The Oakton branch opens for business

The credit union joins the CO-OP Shared Branch network.

1998

Wright Patman Scholarship Program established

The Board establishes the Wright Patman scholarship program for high school seniors in memory of Wright Patman and two of our original board members, Harry Livingston and Edward Kellaher.

To better serve our member base on Capitol Hill, the credit union five convenient ATM locations in the House office buildings.

1999

The credit union prepares for Y2K

As “Y2K” becomes the prevailing topic of the times, the credit union focuses on readiness and member education. Members receive regular Y2K newsletters to keep them informed. A thorough external audit determines that all credit union critical systems are “Y2K ready.”

2000

The credit union celebrates President and CEO Robert Hess for 30 years of service

Left to right: President Harry Livingston, Treasurer Jack Odgaard, and Manager Robert Hess, 1971.

2001

Title sponsors for an important cause

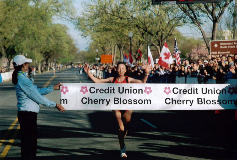

WPCFCU begins sponsorship of the Credit Union Cherry Blossom 10 Mile Run/5K Run-Walk and Capitol Hill Competition. Our Home Banking pilot is launched.

Credit Union Cherry Blossom 10 Mile Run/5K Run-Walk

Credit Union Cherry Blossom 10 Mile Run/5K Run-Walk

Credit Union Cherry Blossom 10 Mile Run/5K Run-Walk

Credit Union Cherry Blossom 10 Mile Run/5K Run-Walk

2002

The Visa Platinum credit card program is introduced

2004

Congressional Federal partners with Children's Miracle Day

The credit union establishes one of its most valued partnerships to support Children’s Miracle Network, which serves 1 in 10 children in North America. As title sponsors, we have helped donate $8 million dollars through this partnership.

2005

Oakton becomes a Shared Branch Service Center Outlet

The Board votes to designate the Oakton Branch as a Shared Branch Service Center outlet within the CO-OP Shared Branch network. This establishes Oakton as a hub for fellow credit union members to receive full-service transacting no matter which organization they belong to.

2006

The BALANCE member education program debuts

The credit union raises over $515,000 for Children’s National Hospital Medical Center.

2008

Assets surpass $500 million

The Board of Directors expands from seven to nine seats.

2009

The Board shortens our name to Congressional Federal Credit Union

2010

CFCU introduces the Transition Loan program

This program is developed to support the unique needs of our members during times of economic transition such as furloughs, job changes or retirement.

2011

Mobile Banking service introduced

The credit union adds student loan products 100% funded through Sallie Mae to its portfolio.

2011 email announcing new CFCU mobile banking

2013

Congressional Federal celebrates its 60th anniversary

CFCU launches its successful in-house mortgage program.

2016

Asset growth reaches $900 million

2017

Milestones in convenient access

The CO-OP Shared Branch network overtakes Citibank and Bank of America branch networks in size. With over 5500 locations nationwide, it becomes one of the largest financial institution networks in the country.

2018

Congressional Federal celebrates its 65th anniversary

Membership has grown to nearly 50,000 members worldwide. Assets exceed $970 million.

2019

Upgrading experience, preserving history

In 2019, we renovated our historic Capitol Building branch to open up space and provide more efficient processing. Room H-129 has 125 years of history in the Capitol Building, from a humble storeroom in 1874 to the office of the House Sergeant at Arms and finally a Congressional Federal Credit Union branch since 1994. Read more about the changes and our branch's unique Capitol Hill history.

2020

CFCU reaches $1 billion in assets

In the first quarter of 2020, Congressional Federal Credit Union reaches $1 billion in assets. With this milestone, our organization now proudly serves nearly 47,000 members and ranks in the top five percent of U.S. credit unions based on asset size.