by

User Not Found

| Mar 30, 2018

A Deep Dive into ARMs

by Jeff Klein, Assistant Vice President of Mortgage Lending & Real Estate

In Part 1 of this series, we learned about adjustable rate mortgages (ARMs), how they work and the benefits they can provide. Here, we’re going to do an example comparison with between a 30 Year Fixed mortgage and a 7/1 ARM to see how much you could save with the ARM in that hypothetical.

When you speak with one of our Mortgage Loan Consultants, one of the first questions they will ask you is how long you intend to be in the home. A conservative yet realistic answer to this question will help us recommend which product is right for you. By matching up the fixed rate period to the length of time you expect to be there (and even adding a few extra years just in case), we can optimize your interest savings and ensure that you only pay for the rate security that you actually

need. How much savings are we actually talking about? Let’s look at an example.

30 Year Fixed vs. 7/1 ARM

Let’s say you’ve recently gotten married and are purchasing a $400,000 starter home in DC. The location is great, but you know full well that the home is a little on the small side and if you start a family in a few years, you’ll quickly outgrow it. You conservatively estimate that you’ll be in this house for 4-5 years and are intrigued by an ARM product. Adding in a few extra years (just in case your plans get delayed) leads you to believe that the 7/1 ARM might be a good option. You ask your Mortgage Loan Consultant to compare the 7/1 against a 30-year fixed in order to determine the best approach. Your Consultant prepares the following analysis:

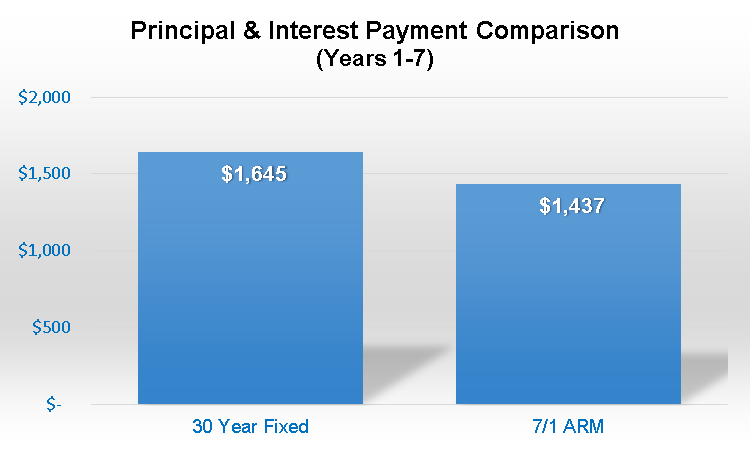

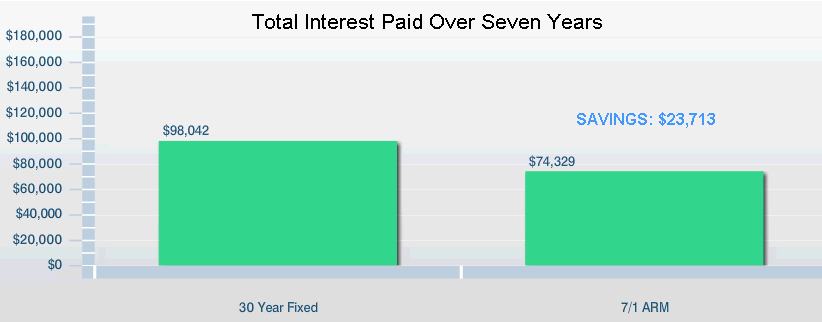

The main thing that jumps out is the difference in monthly payment. Because the rate is 1.125% less, the 7/1 ARM offers a monthly savings of $208. But the real story is the total savings of almost $24,000 over seven years! If you know with relative certainty that you’ll be out of that house by the end of year 7 (or at the very least out of that loan), then your analysis can end right here. The 7/1 is a much better option.

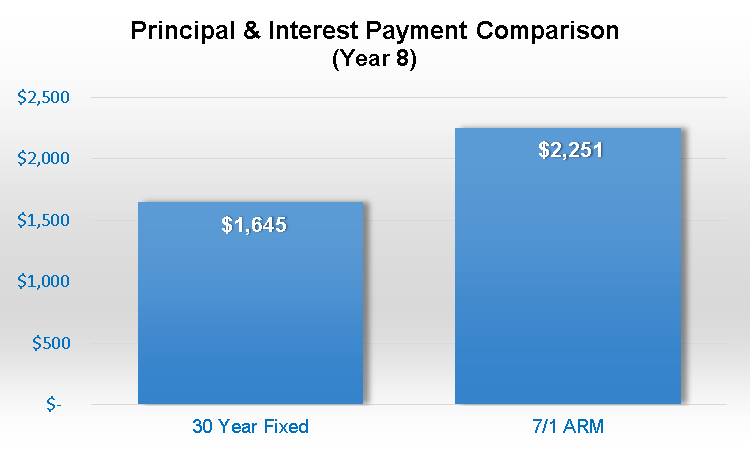

But try as you might, you can’t help thinking, “what if?” What if you decide you really love this house and don’t want to move? What if it takes longer to sell the home than you expected? Let’s explore that worst-case scenario. On the 7/1 ARM, the rate can adjust 5% upwards during the life of the loan. Assuming rates move sharply upwards, here’s a comparison of your monthly payment in year 8.

Definitely a different story. Your monthly payment has increased significantly, and is now higher than it would have been if you had gone with the 30-year fixed.

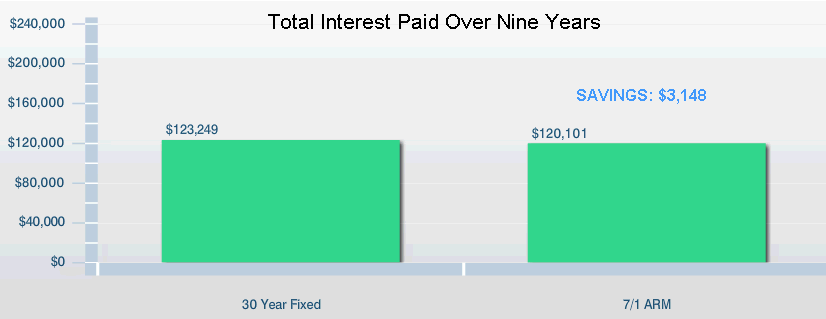

But remember – you saved nearly $24,000 in the first seven years. So while your payment is higher in year 8, overall you’re still ahead. Same story after 9 years, and it’s not until month 117 (nearly 10 years later) that the 30-year fixed overtakes the 7/1 ARM in terms of total interest paid.

So, what does this all mean? Well, it probably means different things to different people. Some people are completely risk averse, and for them there is no price too high to eliminate uncertainty.

And there is nothing wrong with that!

Others, however, will look at the example above and consider the following: even in a scenario where the member’s initial estimate of 4-5 years in the home became 10, and even when the initial interest rate increased by 5%, the 7/1 ARM still was no worse than the 30-year fixed from the standpoint of total interest paid. Not to mention that in 10 years, there’s a good chance the following will also be true:

• Your home will have likely appreciated in value

• The balance on your loan will have been paid down over ten years

• Your annual income may also have grown substantially (depending on your life stage)

I should also point out that none of our mortgages carry prepayment penalties. Assuming you can qualify, you are free to refinance at any time if your situation changes.

The example above may either scare you or interest you. Regardless of which category you find yourself in, I hope that what is evident is that there is no right or wrong answer.

Despite what you may read or hear, there are very few bad mortgage products. There are only bad fits for one’s specific situation. What we do here every day is try to match the product to the member. Ultimately, you are the one who needs to rest easy at night, and we would never match a member to a product that didn’t mesh with their risk tolerance and personal financial goals.

Introducing the 5/5 ARM1

It was with that in mind that we developed our newest product, the 5/5 ARM. Similar to the 5/1 ARM, the 5/5 carries a fixed rate for the first five years. But instead of adjusting annually, it adjusts only once each subsequent five years. And to make it even more appealing, we added a 2% cap on each adjustment. The 5/5 ARM truly offers a unique blend of a low rate with additional rate security, designed for the needs of our membership in the transient DC area.

So contact one of our expert Mortgage Loan Consultants today for a no-cost consultation to determine if an ARM is right for you. Whether you are looking to purchase or refinance, we would love the opportunity to help you achieve your home financing goals.

1Sample 5/5 ARM loan terms for a purchase loan of $320,000 secured by a property located in Washington, DC with an 80% LTV based on market conditions as of March, 2018: A 3.25% interest rate with 0 points and a 4.669% annual percentage rate (APR); payable in 360 monthly installments where the first 60 months will be at a payment of $1,392.66 with a corresponding simple interest rate of 3.25%; the next 60 months will be at a payment of $1,712.54 with a corresponding simple interest rate of 5.25%; the next 239 months will be at a payment of $1,748.23 with a corresponding simple interest rate of 5.5% and the remaining 1 month will be at a payment of $1,747.65 with a corresponding simple interest rate of 5.5%. Rates subject to change. Loans subject to credit approval. If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.Click here for full information about 5/5 Adjustable Rate Mortgage costs and terms